Economist: ‘Better’ wheat, cattle markets seen for 2024

Published 5:00 pm Wednesday, February 7, 2024

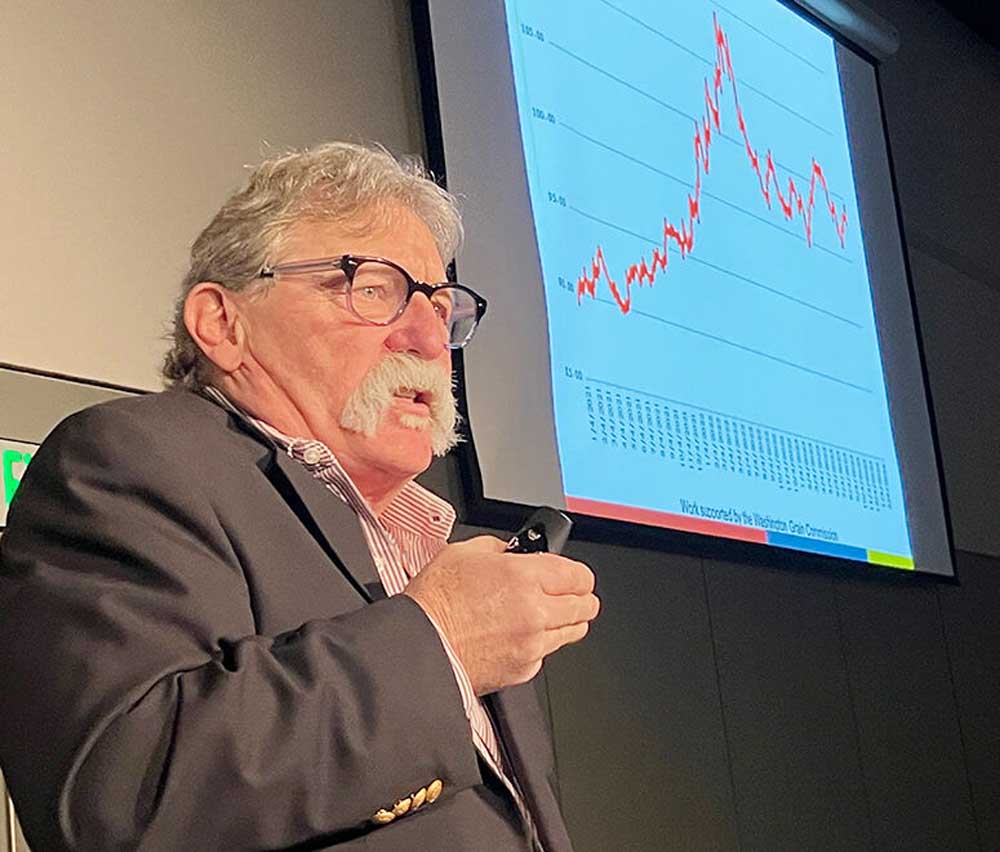

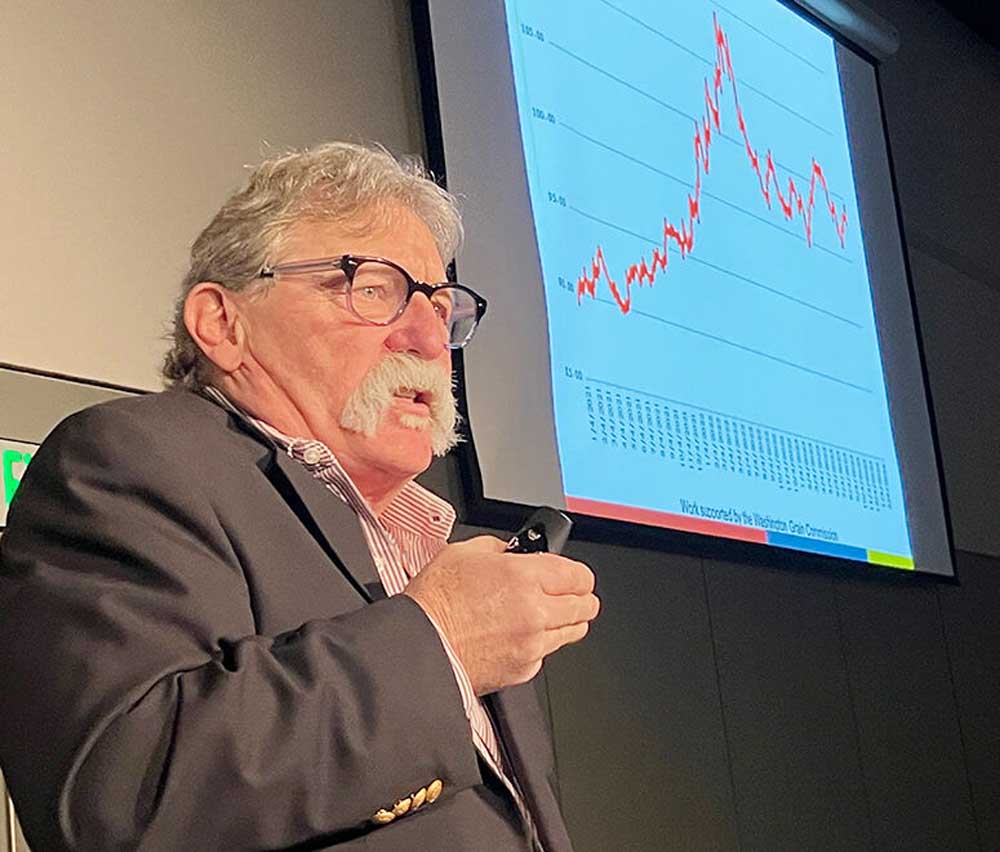

- Randy Fortenbery, Thomas B. Mick Endowed Chair in Small Grains Economics at Washington State University, delivers his annual market forecast Feb. 7 during the Spokane Ag Show. "Wheat and small grain farmers may be a little better off if prices hold up, and the same with cattle," Fortenbery said.

SPOKANE — Wheat farmers and cattle ranchers may see higher prices in 2024 compared to last year, but other Washington commodities might not fare as well, an agricultural economist says.

Randy Fortenbery, the Thomas B. Mick Endowed Chair in Small Grains Economics at Washington State University, expects “better” wheat markets, especially if farmers have decent yields.

Cattle prices are “quite strong” compared to a year ago. But every other livestock sector, particularly dairy, was down significantly, Fortenbery said.

Last year, U.S. net farm income decreased by an inflation-adjusted 20%, following record income in 2022, said Fortenbery.

“It varied a lot, based on where you were and what commodity or agricultural production systems you were involved with,” he said. “We’re going to see a larger divergence between who does well in 2024 than we even saw in 2023.”

Softening prices drove the income decrease, Fortenbery said.

This year, wheat prices could range from about $5.50 per bushel to below $7.50 per bushel, Fortenbery said.

“It’s a pretty wide range, because we’re still a long way from knowing what this winter wheat crop is going to look like as we approach the summer,” he said. “If you get $7, you should probably think about taking it because pretty soon, if you start approaching $8, the market’s saying there’s a 75% chance we can’t hold that as we go into the summer months.”

Fortenbery presented his annual economic outlook Feb. 7 at the Spokane Ag Show.

Costs increase

Costs are up significantly compared to 20 years ago, but dropped between 2022 and 2023, Fortenbery said.

Feed, fertilizer, pesticides and fuel prices went down, offsetting the increased costs of labor, interest rates for land purchases and production loans, livestock or poultry and seed.

“When we combine all those together, in aggregate across the U.S., the cost structure was pretty flat,” Fortenbery said.

Hired labor is the No. 1 expense for agriculture statewide, at about $3.2 billion in 2022, although it varies by sector, Fortenbery said.

“For wheat producers, it probably isn’t,” he said. “For tree fruit producers, it very much is.”

Farm bill delay

Fortenbery doesn’t expect a new farm bill until well after the presidential election.

Sen. Debbie Stabenow, D-Mich., chair of the Senate Agriculture Committee, recently proposed giving producers the option of accepting a higher subsidy for their crop insurance premium or a higher reference price.

Fortenbery doesn’t expect either proposal to move in the House of Representatives.

“The Republicans are interested in raising reference prices, but they want the budget to be neutral, or even less costly than the last farm bill,” he said.

“In the more right side of the House, there’s an unwillingness to go along with anything that ends up looking like a compromise, and the farm bill has always been a big compromise,” he said.

Crop protection

“We’re kind of at that point where it’s a 50-50 proposition which one of these will be the more attractive going forward,” Fortenbery said of the federal crop protection programs.

Farmers must sign up by March 15.

Payment for the Price Loss Coverage program (PLC) is based on the national average marketing year price. USDA will give an estimate in several weeks and a final price in June.

Fortenbery used the December futures price for soft red winter wheat, about $6.32 per bushel, to make his prediction for the final marketing year average price, multiplied by 0.95, about $6 per bushel.

A PLC payment is triggered when the average price falls below $5.50 per bushel.

The Agricultural Risk Coverage County program (ARC-CO) is probably a better way to go, Fortenbery said.

He advised farmers to consider whether price or yield is their biggest risk.

“If you’re more worried about yield, then you should sign up for ARC-CO,” he said. “If you’re convinced your yields are going to be excellent, and there’s nothing that’s going to affect that going forward, then the only way you’re going to get paid is if the price falls, and you want to sign up for PLC.

“I guarantee you, whatever I tell you to do will be wrong by the time we get to next year, because we are right on that threshold,” Fortenbery added.